In almost every town in the UK you will find a JD Wetherspoons pub offering food and drinks at prices often considerably cheaper than rivals to the point where the brand has become a part of the nation’s consciousness.

However, constantly undercutting the competition isn’t always the best way forward and in the face of lost revenues in the pandemic and a cost of living crisis prices have been forced up at Wetherspoons weakening its key selling point.

Founded in 1979 by Tim Martin, Wetherspoons have always done things differently: from bargain booze, no music in pubs, unique carpets to toilets up a mountain of stairs, Wetherspoons pubs have a certain way about them that no other chain can match to the extent where the brand has earned loyal fans who travel to all its establishments.

This is a pretty impressive feat considering Wetherspoons have shunned all advertising and don’t even have a brand social media presence – clearly something the chain deems an unnecessary expense.

However, in making their USP being cheaper than their competitors Wetherspoons made a great challenge for themselves balancing the books especially in the face of a global pandemic and cost of living crisis.

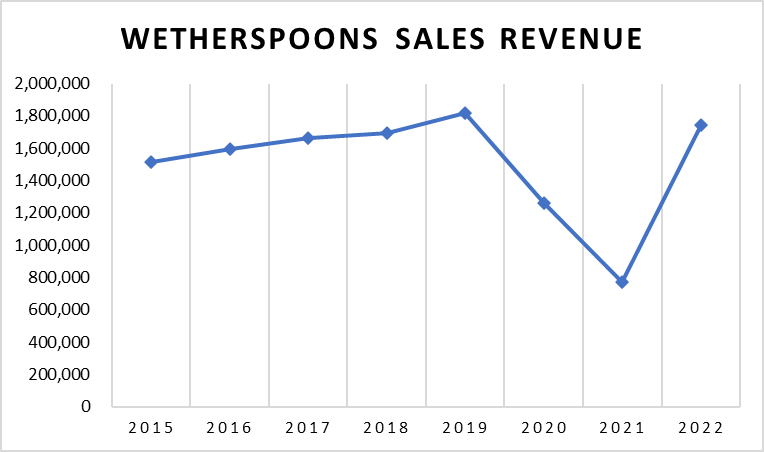

Wetherspoons had been on a run of increasing revenues as the business expanded and opened more establishments however that impressive run ended with the Coronavirus pandemic and the business has yet to return fully to pre-pandemic levels.

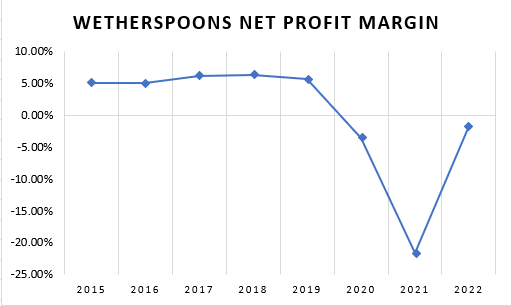

This has also hit Wetherspoons’ bottom line as their low-cost model took a battering when their costs were spiralling and they weren’t in a position where they could hike prices without losing favour with customers, this has led to mounting losses as their margins were slim in the first place.

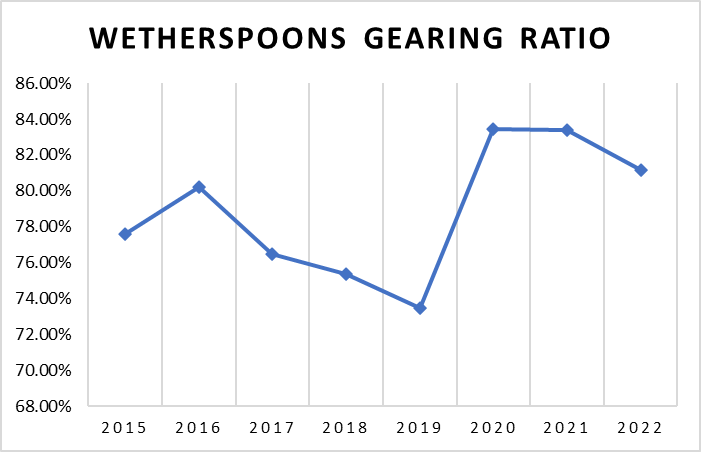

The effects of the pandemic are still being felt by Wetherspoons as the business had to take on debts in order to keep the business afloat due to the lockdowns which had closed the doors and reduced revenues to near-zero.

However, it seems that Wetherspoons are starting to reduce their borrowings as their gearing ratio fell in 2022 as the business began to recover from its Covid-19 troubles.

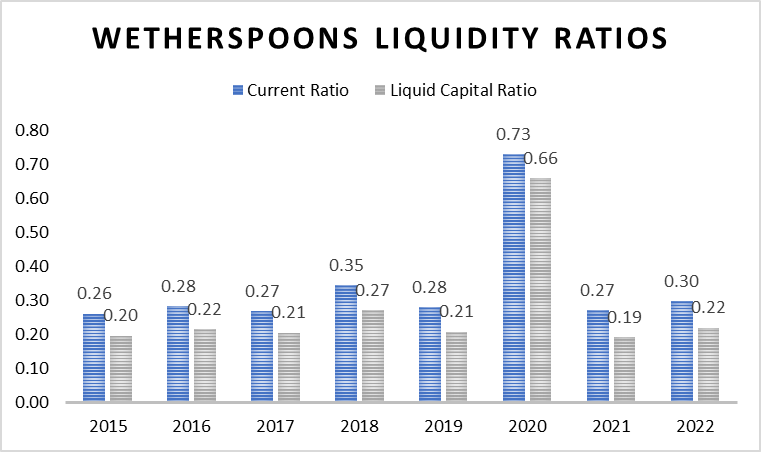

A more persistent problem at Wetherspoons is liquidity. For years, the business had been operating with very limited cash reserves and therefore a current ratio on average of 0.29:1. This can work if the money keeps flowing in but if there was to be another sudden shock to Wetherspoons trading there is a very real possibility it could not cover its day to day expenses.

In order to try and increase their profits, Wetherspoons engage in a competitive pricing strategy in which they charge prices relative to other competition in the area their pubs operate and this can mean variations in the price of identical meals.

This has been a criticism levied at Wetherspoons for years as they used to charge different prices for identical products in the same town, this has reduced somewhat but there are still variations in what you’d pay depending on where you sit down for your pizza and a pint.

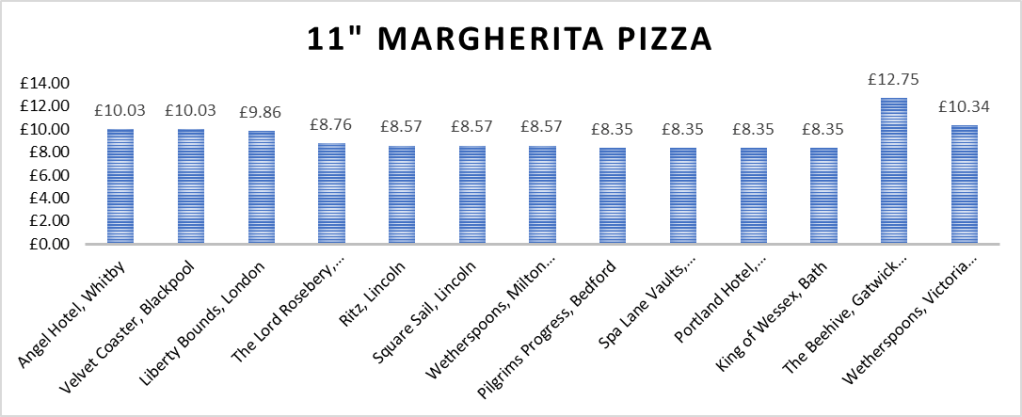

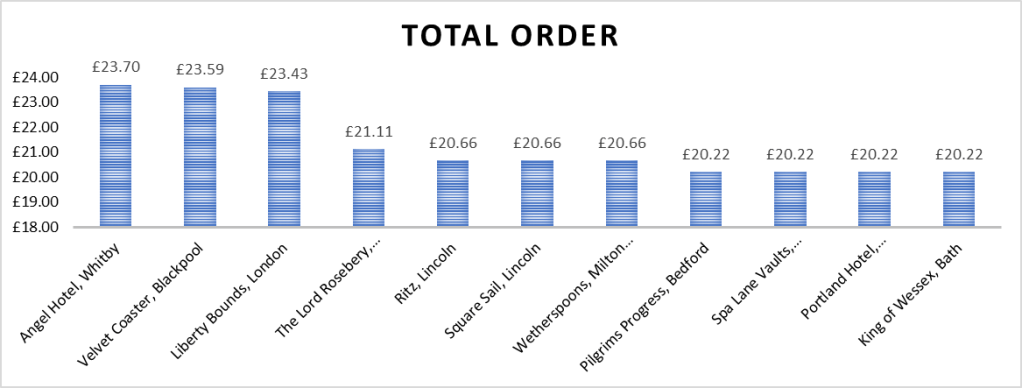

To investigate this, I compared the prices of a hypothetical order (fish and chips, margarita pizza and a J20) on the Wetherspoons app on the same day in August and these were the findings.

As you can see, there is quite a bit of variation for the exact same meal depending on where you eat it. If you were staying at The Angel Hotel in Whitby, a trip 20 miles down the road to Scarborough would save you 15% on the cost of your pizza.

Additionally, if you were to visit a Wetherspoons at an airport or a train station, be prepared to pay a lot more for your meal – especially as the pizzas at Gatwick Airport don’t include a drink with the meal.

Prices for drinks do not seem to fluctuate as much which is probably a benefit for some.

As you can see, not everything is lovely and rosy for Wetherspoons but I’d say they are probably in one of the better positions in the hospitality sector and are recovering from the pandemic. However, if the cost of living crisis continues and their operating costs continue to increase while customers are cutting back the picture may not stay as good.

Do comment your thoughts below.

Leave a reply to Gabriella B Cancel reply