Debenhams’ liquidation in 2019 meant yet another high profile, high street casualty as the retail landscape moves online. The department store retailer – founded in 1778 – fell from grace over many years but mounting debts and shrinking profits led to the retailer collapsing, leaving 25,000 staff and 118 stores behind.

Like many of its competitors and contemporaries, Debenhams failed to effectively make use of the internet and was slow to recognise the digital revolution and fully act on it meaning that its sales were cannibalised by the rising number of online retailers in the market such as ASOS and Amazon.

Debenhams heavy reliance on bricks and mortar stores meant its fixed costs were constantly high and left them unable to compete with those online whose lower overheads meant they could offer cheaper prices while maintaining profit margins.

In 2005, Debenhams sold 23 stores to a property investment company for £495 million and then leased them back. This short-term cash boost locked the retailer into expensive leases lasting up to 35 years. As a result, the business found itself under a mountain of debt reaching £620 million in 2018.

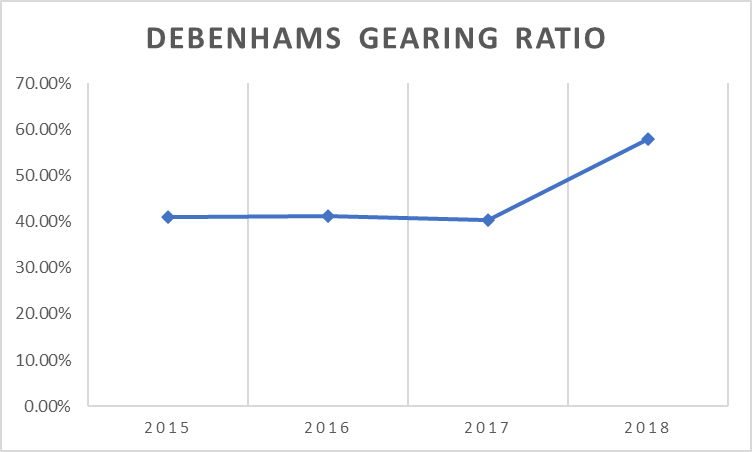

This gave Debenhams a relatively high gearing ratio meaning the long-term debts were a significant proportion of the value of the business.

In addition, Debenhams also had short-term cash flow issues due to a lack of liquidity within the business. In the final four years of operations, Debenhams had an average liquid capital ratio of 0.16:1 meaning that they had minimal working capital and would seriously struggle to cover the day-to-day costs in the business.

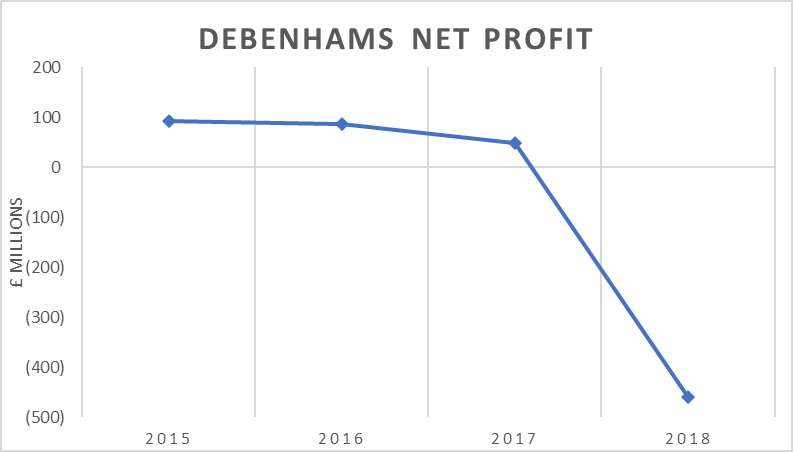

These costs were also generally increasing putting Debenhams under more pressure as decreasing profit margins then led to mounting losses leaving the department store chain in an unenviable position.

The culmination of these factors led to the centuries old retailer collapsing making share holdings worthless (coming at great expense to retail tycoon Mike Ashley) and leaving thousands of workers without redundancy payments with some still waiting three years later.

However, the name and legacy of Debenhams lives on after the brand and website was acquired by online fashion retailer Boohoo in 2021 for £55 million although thus far this takeover has only produced losses.

Do comment your thoughts below.

Leave a reply to David Sperry Cancel reply