University is often the time that people manage their own money for the first time, and if you are in that situation then you probably have a lot of questions and areas of uncertainty. But fear not, here is your complete guide to student money which not only tells you what products to get, but also how things actually work.

And bear in mind, this is written by someone that is also starting university so I have some of the same concerns as you of stepping into the scary world of personal finance so we can struggle through this together.

1 – Student Finance

In most cases, student finance is something you can’t go to university without, so you need to get to grips with who they are, what they do, when you will be paid, and when you will need to pay this back (because university isn’t free anymore).

Everyone is entitled to the tuition fee loan (£9535 per year) and this is paid directly to your university once you enrol. In addition to this, you will also receive a maintenance loan which is calculated based on your household income with the maximum (for students living away from home but not in London) being £10,544 and the minimum being £4,915 (in England).

The implication in the student loan system is that the shortfall between your loan amount and the maximum (or the amount you need to live on, as they are not the same) is paid by your parents/carers as the assessment is based on their income. For some, this is not possible so you will need to look at either employment, money from savings, or bursaries/scholarships to help you cover the costs.

Once you know how much you are getting, you need to check student finance to see when it is coming. For many, this will be the week after freshers’ week thus leaving you with a gap that needs to be plugged. The main ways to do this are using savings (or money from employment over the summer), your overdraft (more on that later), or asking your parents to give you money as soon as you start university (I’ll let you decide whether that’s an option for you).

Also check before you go that the bank details you have given Student Finance England are correct and are that of the account you plan to use. Most people will have applied for student finance in Y13 and may have a new student bank account, if you want your loan to be paid into that account, make sure that student finance has those details asap because you don’t want to be wondering where the money is when rent is due.

2 – What bank account should I get?

Your student bank account is probably the best bank account you will ever get as the banks are pulling out all the stops to try and get your custom (as they know that people are unlikely to switch away from the bank they had at university).

This means there are a multitude of offers to take advantage of, but there is another benefit to student bank accounts – the interest-free overdraft.

An overdraft is a borrowing facility that allows you to spend more than is in your bank account but of course this has to be paid back at a later date. Most normal overdrafts have ridiculous interest rates (circa 40%) but for students, banks don’t charge interest.

This doesn’t mean the overdraft is free money, it is merely a tool to use to help you manage your cash flow. As previously mentioned, it is likely that you won’t receive your maintenance loan before freshers therefore using your overdraft may be the way to finance that. If you are going to do that, ensure you have planned how much you can afford to spend in advance so you don’t end up perpetually in your overdraft for the entirety of university and then paying it off with interest when the interest-free period ends.

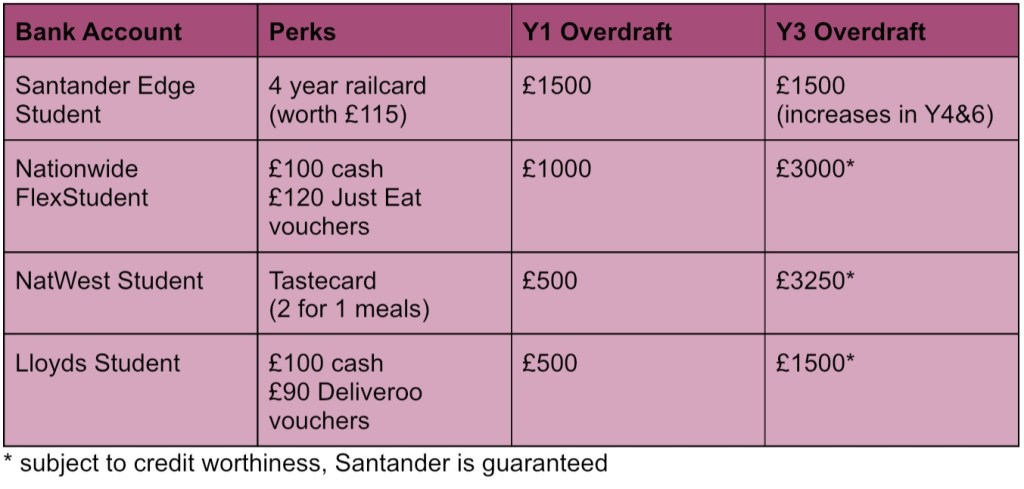

So, which bank account should you get? Well, here’s a table comparing the freebies and levels of overdraft the major banks are offering so you can make an informed decision.

3 – And what should I do about savings?

If you have savings, or want to build up savings while at uni, then you will be wanting a savings account (rather than just using your bank account).

At the time of writing (August 2025), you should not be settling for less than 4% interest on your savings. As the top savings accounts change so frequently, I will not be listing them here but if you look on MoneySavingExpert.com you will be able to find the best savings rates.

Some banks might offer you a savings account alongside your student bank account, they are always worth considering but if the rate can be beaten elsewhere, then it’s probably worth using two banks (trust me, it’s not as complex as it may seem).

If you have a lot of savings or are saving for the long-term, it may be worth thinking about investing. I’m not going to tell you what to invest in or whether you should because it’s a personal decision based on your attitude to risk and if you are willing to take the chance of losing money. All I will say on this is don’t put money in investments if you need to access it in the short term as you could risk selling at a poor time, and find a platform that charges low fees but is also easy to use.

4 – Savings is optimistic, what do I do about debt?

Most people going to university will have just turned 18, and therefore will be able to access most of the debt products on the market. As with investing, I’m not going to tell you whether to borrow money or not, I will just repeat the warning that debt is like fire: it is an incredibly useful tool but equally has the power to burn you and the consequences of a debt spiral can be harsh, both personally and financially.

But, debt can be a useful tool at university if you want to build a credit score for use in the future (such as to secure a mortgage). If you use your overdraft wisely, then that can positively impact your credit and the same goes for a credit card. If you spend a small amount on a credit card each month (£10-15), and pay it off IN FULL to avoid interest then that can have a positive effect on your credit worthiness.

But remember, that any irresponsible use of credit will also affect your credit worthiness and ability to get credit in the future. Buy Now Pay Later services like Klarna, ClearPay and PayPal appear on your credit file so use them wisely. Also, don’t touch payday loans with a bargepole, see here for why.

5 – What about student discounts?

There are a wide array of discounts available to students by virtue of the fact that students typically don’t have a lot of money. I will not be listing every student discount here because there are hundreds but I have some suggestions on how to find more.

There are apps which collate discounts and have relationships with various businesses to offer more student discounts. UniDays and Student Beans are free to use and have deals with Apple, Trainline, and Superdrug (to name a few).

Also, don’t forget discounts that are available to everyone but can be useful to you too. Find out which supermarkets are near your university/accommodation and sign up to their loyalty programme (in advance because it sometimes takes days for loyalty cards to come in the post).

6 – But how do I actually manage my money?

The most obvious advice on how to manage your money is to do a budget. This doesn’t have to be a complex spreadsheet listing every penny you spend money on (though if you think you can keep that up then go for it) but at least work out how much you can afford to spend each week once the essentials are paid for (accommodation, food, bills).

To be more organised, you could automate your finances. If you have worked out that you will have a certain amount left over and plan to put it into savings or investments, then set up a direct debit or automation (depending on your bank) to pay this at the start of each term or week so that you are saving what you plan to.

Alternatively, you could split your money into different ‘pots’ (you may need a techy bank for that like Monzo or Plum) for spending categories such as food, going out, and clothes so that you aren’t going over your budget.

7 – Bills?

If you are living in university-run accommodation, then bills are unlikely to be an issue as the university is likely to sort that and incorporate the cost into your accommodation. If you are renting privately, however, then this becomes your responsibility.

Check who your utilities providers are and if you are able to switch them, if so, look for a cheaper deal on a comparison site. Also, as a full-time student, you are exempt from council tax therefore you may need to write to your council to ensure you don’t pay council tax.

Finally, even in university halls, you may need contents insurance (to insure your belongings from damage or theft) so check if your university uses a particular insurer or if you need to source it yourself.

If you have any questions, message me on Instagram (@gabriellalbedford) or comment below.

Leave a comment