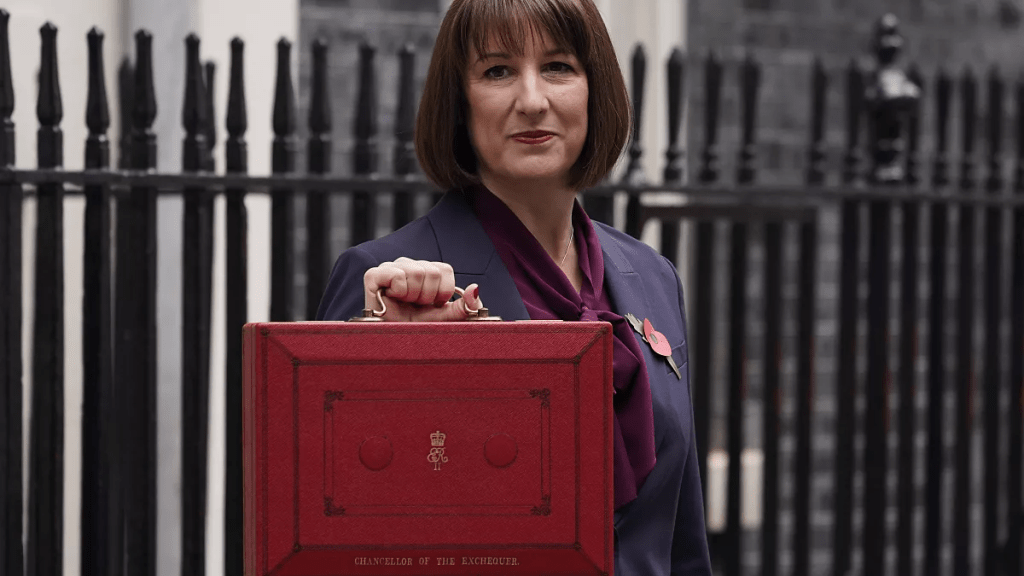

After much anticipation, today Rachel Reeves delivered the first Budget of our new Labour government and (arguably more importantly) the first ever Budget from a female Chancellor.

And she certainly packed a punch. In a speech which lasted over an hour, Reeves detailed how she aims to repair our public services and fill the £22bn black hole left by the previous government through a raft of tax rises on the wealthier members of society.

But amongst the tax hikes, spending pledges and political rhetoric which always proliferates these events were some key changes which could hit your personal finances and this is what I will be focusing on today (particularly the changes which were notably absent in the monsterous speech).

The changes in your paypacket

Throughout the election campaign, the Labour Party pledged to protect ‘working people’ (are we sure who the working people actually are yet?) and this is something which Reeves achieved.

There were no rises to neither VAT, National Insurance nor Income Tax and on the latter the threshold freeze has not been extended beyond 2027 meaning that there is an effective tax cut on the horizon.

In addition, the minimum wage has risen for those aged 22 and above to £12.21 per hour and for 18-21s to £10 per hour: both on the recommendations of the Living Wage Foundation.

Benefits

A change mentioned in the Budget speech (and a very positive change) is that for those on Universal Credit who owe HMRC, are behind on their Council Tax or have other debts, the amount of their UC income that can be taken for repayments has been reduced from 25% to 15% meaning that people have more money in their pockets.

However, in the document that comes alongside the Budget, it was revealed that the proposed changes to the Higher Income Child Benefit Charge would not be coming into place.

Currently, a single parent earning over £60,000 do not get child benefit whereas a family with two parents earning £59,000 would get child benefit meaning that the system is unfair to single or majority earner households. Under the Conservative government, this system was to be changed to a system of household assessment however this fairer idea has been scrapped.

A more positive benefits change that has been hidden in the small print is the extension of Help to Save. Help to Save is a scheme by which recipients of Universal Credit can get a 50% uplift on their savings (to a certain level) and this scheme has been extended to 2027 with eligibility also expanded to more claimants of UC.

Housing

There were two changes to Stamp Duty (Stamp Duty Land Tax – SDLT) in this Budget – one mentioned in the speech and another buried in the supporting document.

In the speech, Reeves announced an increase by 5 percentage points to the rate of SDLT levied on the purchase of second homes to 8% which should free up properties for first time buyers to purchase.

However, the current Stamp Duty thresholds are higher due to a Conservative policy from previous Budgets and in the document accompanying today’s speech it was revealed that these thresholds would decrease to normal levels. This means that the threshold for first-time buyers would fall to £300k (from £425k) and for everyone else to £125k (from £250k) meaning they are liable to pay more SDLT.

A change which would support the housing market which sadly did not materialise was the ending of the penalty on withdrawals from the Lifetime ISA. Currently, those who use a LISA get a 25% bonus on their savings from the government but if they withdraw their money they are charged a 25% charge which (due to wonders of maths) leads to a 6.25% penalty.

With house prices rising across the country, many first time buyers are buying properties worth more than the £450k qualifying threshold meaning that if they use their LISA savings towards the property they incur the penalty.

Pensions and Savings

The two decisions related to pensions were announced in the speech: the maintaining of the triple lock and the fact that pensions will soon be liable for Inheritance Tax.

Firstly, the triple-lock means that pensioners will see an uplift of 4.1% in their state pension next year which equates to up to £475 for someone on the new full state pension.

Secondly, on private pensions, currently they do not form part of your estate and are exempt from Inheritance Tax however from 2027 they will be eligible to have IHT charged on them. It is not yet known whether pensions will count towards your Nil-Rate Band (£325k) or have their own threshold.

A change to savings which did not form part of the speech was the quiet demise of the British ISA. This was a new ISA announced by Jeremy Hunt in the last Budget which would have its own allowance for supporting British businesses however it has been scrapped (probably a good idea).

Do comment your thoughts below.

Leave a comment