Trying to convince young people to learn about finance and take an interest isn’t the easiest job in the world for anyone so people have tried to find cool ways to engage people: be it incentives for children’s banking or today’s topic…gaming.

Online gaming is massively on the increase with the market valued at over $60 billion, this means that an awful lot of people play games – most in younger demographics.

It’s estimated 91% of children aged 3-15 play games online which presents a prime opportunity to try and use the time spent gaming teaching these young people something productive – like the basics of personal finance.

This opportunity has been taken by a partnership between Visa and the Roblox game LiveTopia who produced the in-game ‘Visa Farmers Market’ full of financial minigames.

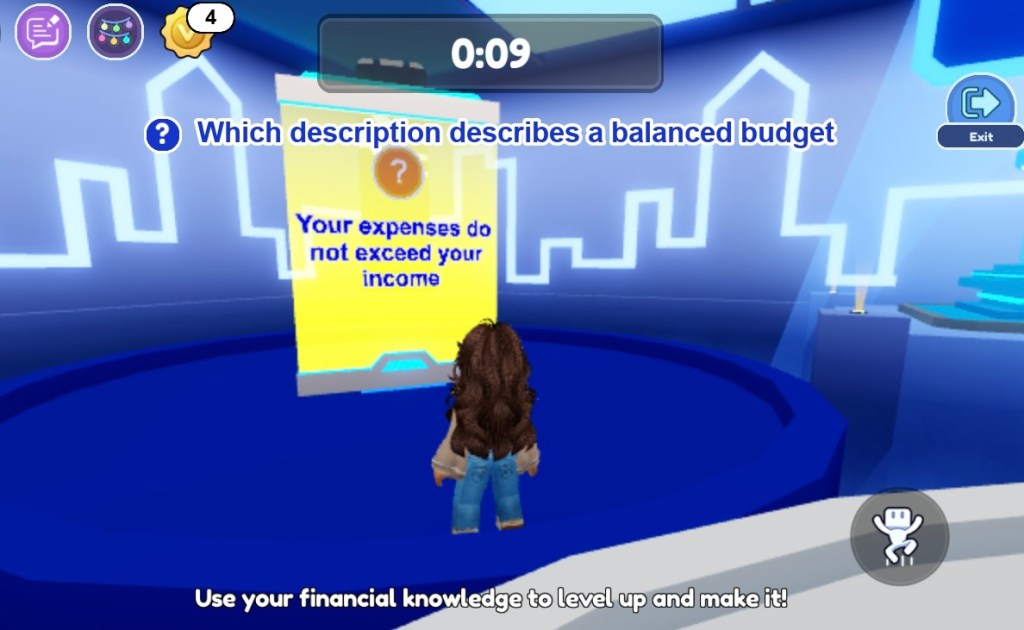

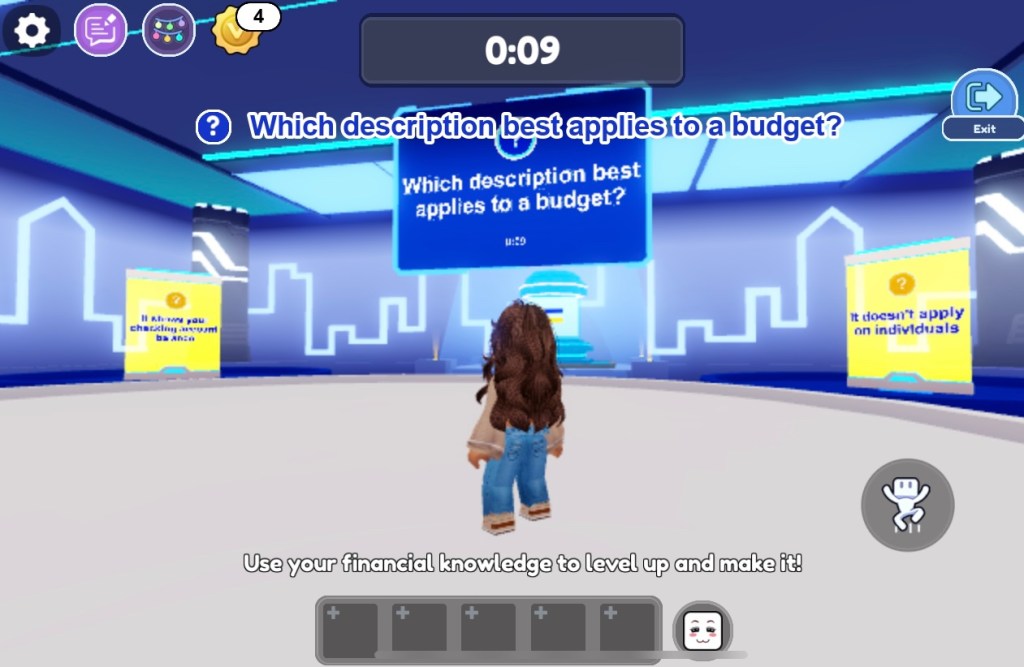

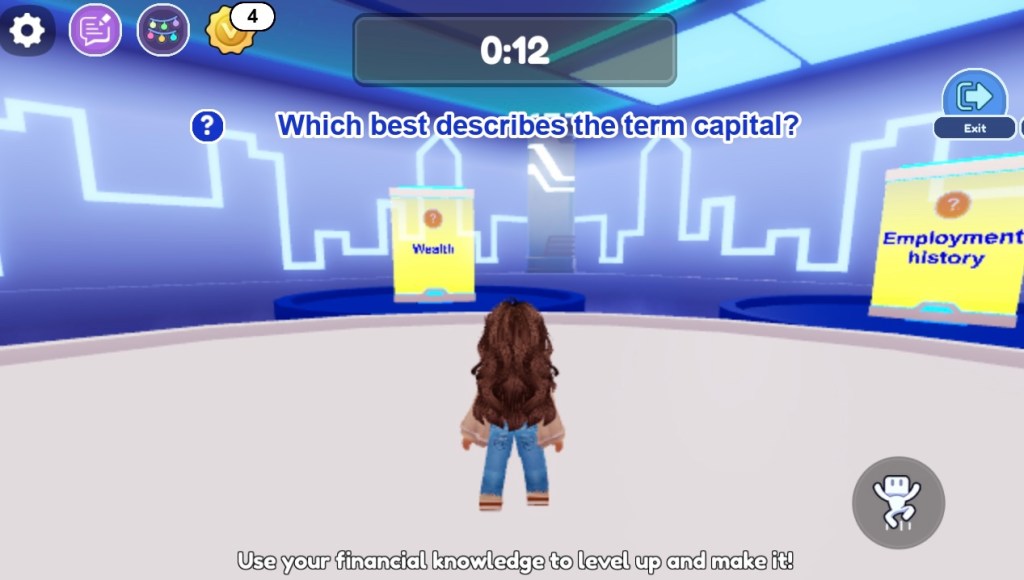

These games teach the basics of personal finance firstly through a rather fun activities asking questions about debt, budgeting and basic asset management.

One of the games was a brief financial quiz which earned points that could be spent on items, the questions were nothing too taxing but would still probably provide people with more financial information than they started with that could be useful.

The questions (which were sometimes tricky) also came with a time limit so it would be very hard to Google the answers – actually requiring people to think and learn!

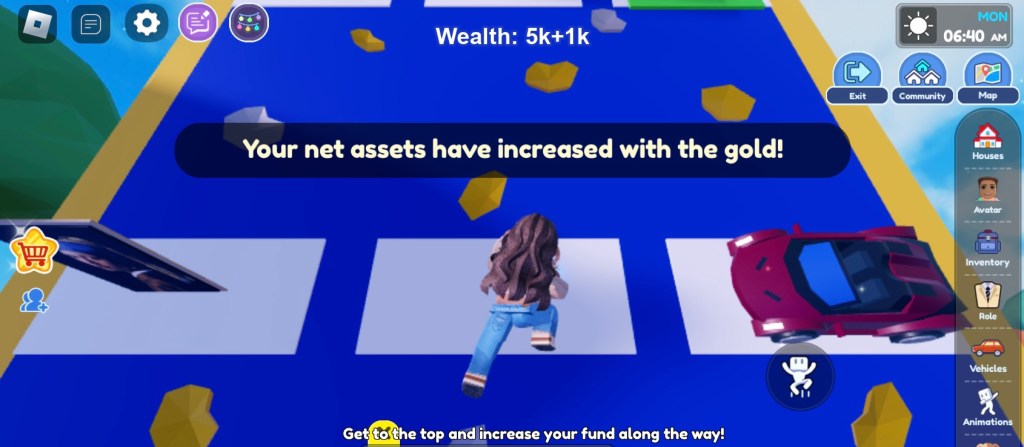

Another financial activity within the game revolved around building your net assets/net worth through accumulating different assets – limited skill is involved in this but if young people are more responsible with decisions then it’s good.

This recent attempt at improving financial literacy through gaming reminded me of a game from my childhood: a game on a CD-ROM (how old!) which taught about saving water and therefore money. I enjoyed this game however you had to make a conscious decision to play a game about saving water (unlikely) which is where this is different.

Incorporating financial education into games that young people already actively play (LiveTopia has over 3.9 billion users) means that they will innocuously learn about money without having to actively sit down and face a page full of finances (weirdly not everyone sees this as cool).

I think incorporating personal finance into other aspects of life will improve financial literacy overall but it is not the definitive answer, people will not be able to learn everything they need from a game so proper education (especially in schools) is still the answer.

Do comment your thoughts below.

Leave a comment