Welcome to the Formula One Financial World Championship, a competition comprising nine of the fastest racing teams on Earth but with a twist. The team who tops the standings will not have the fastest car, nor the quickest driver, neither the most pushy team boss – this is a championship to determine the most financially sound F1 team.

You may assume the most financially sound team would be the reigning world champions, they are awarded the most prize money of course however this may not be the case (yes, that means there is an F1 championship running in 2023 Red Bull will not win – joy for us fans of the other teams!).

The championship consists of the teams’ financial accounts undergoing serious scrutiny with four accounting ratios calculated to determine an order. The most recent published accounts have been used which in most cases is 2021 with the exception of Aston Martin who only have 2019 (when they were Racing Point). Additionally. Alfa Romeo have been omitted due to having no published accounts and Ferrari’s are for the whole company (not just the F1 outfit).

This week we’re moving into the final stage of the competition with my favourite ratio and the final standings…

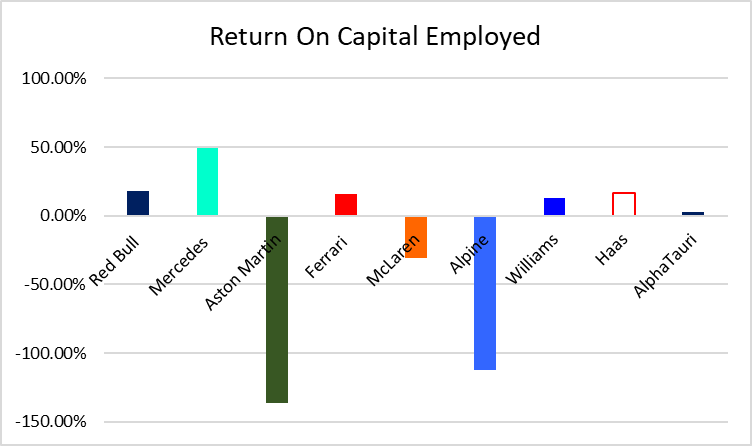

Return on Capital Employed (ROCE)

Return on Capital Employed is a measure of how efficiently a business (or an F1 team in this case) is using its resources to generate a profit. This is a key one for a business as it shows whether they are working efficiently, not wasting money/resources and making the most of what they have (crucial for the smaller teams).

Clear winner in this round is Mercedes (unsurprising under the rule of business graduate and honorary Harvard professor Toto Wolff) with an impressive ROCE of 49.33% which is a combination of a decent operating profit and lower capital employed figure. Hot on their heels are Red Bull (it’s like 2021 all over again) but also Haas and Williams have a good ROCE.

Seriously disappointing are Alpine and Aston Martin with negative figures over -100% but for totally different reasons. Aston Martin’s figure is because of their monumental operating loss however Alpine’s is due to negative capital employed as a result of high current liabilities (so no working capital) which will become relevant later…

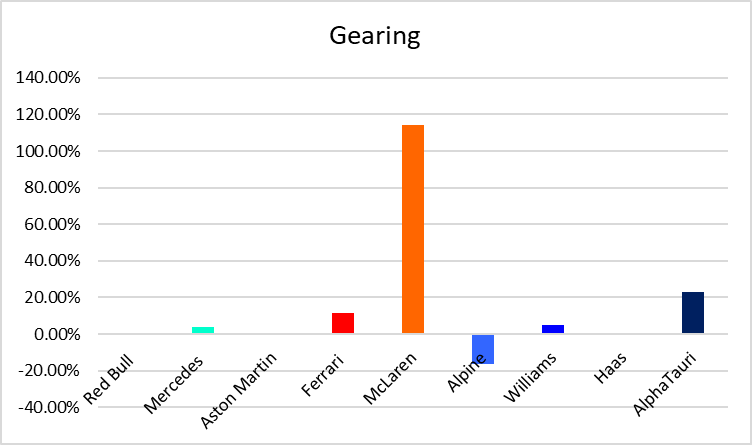

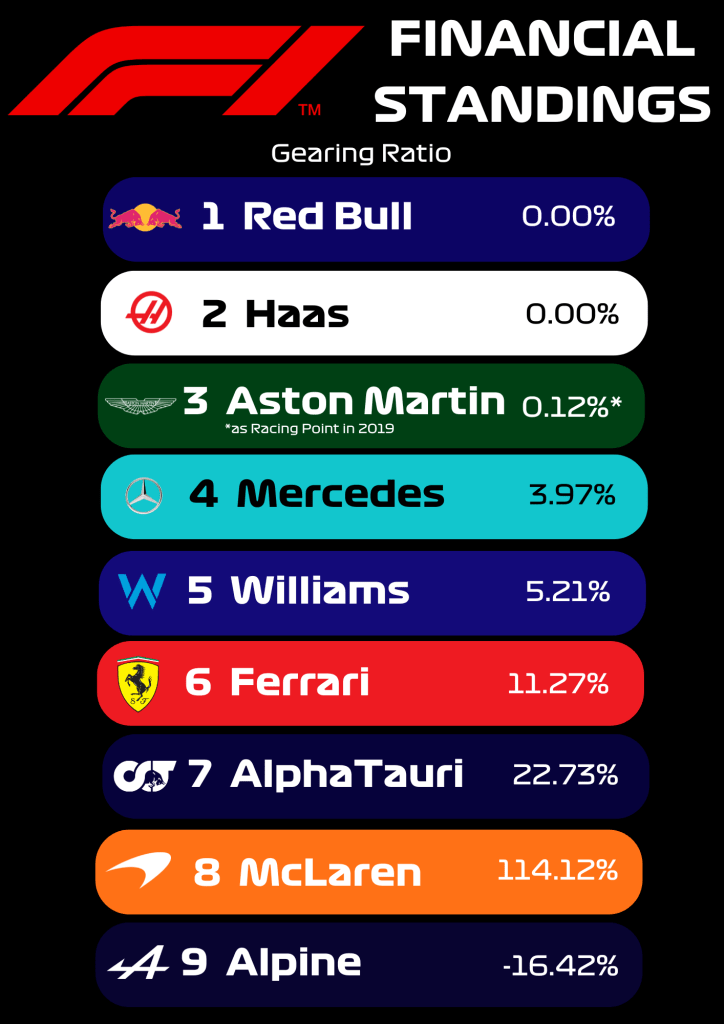

Gearing Ratio

The gearing ratio (my absolute favourite financial ratio) compares a business’ long term debts to its resources (capital employed). Now with F1 teams some have very little borrowing meaning their ratio is kind of irrelevant. Also, note that a higher number is worse in this.

As you can see, four teams have negligible debts which is great (for them) although some are rather concerning. Firstly Alpine who have a negative capital employed figure due to a frighteningly high level of current liabilities and then McLaren who have more borrowing than most of the others combined – hopefully the new owners are sorting that out!

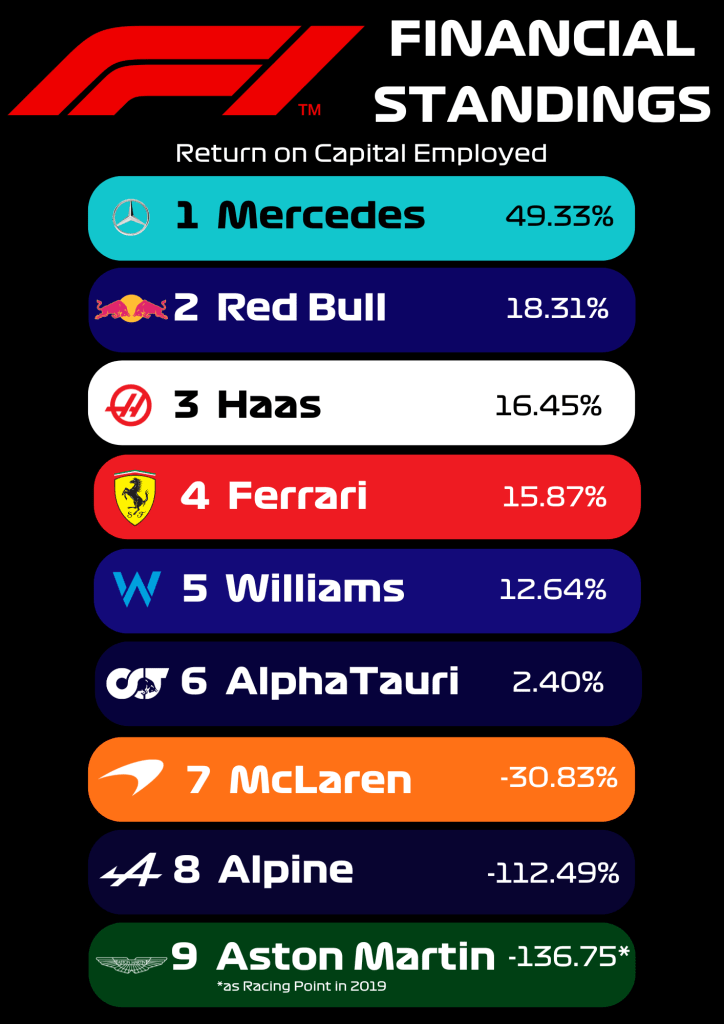

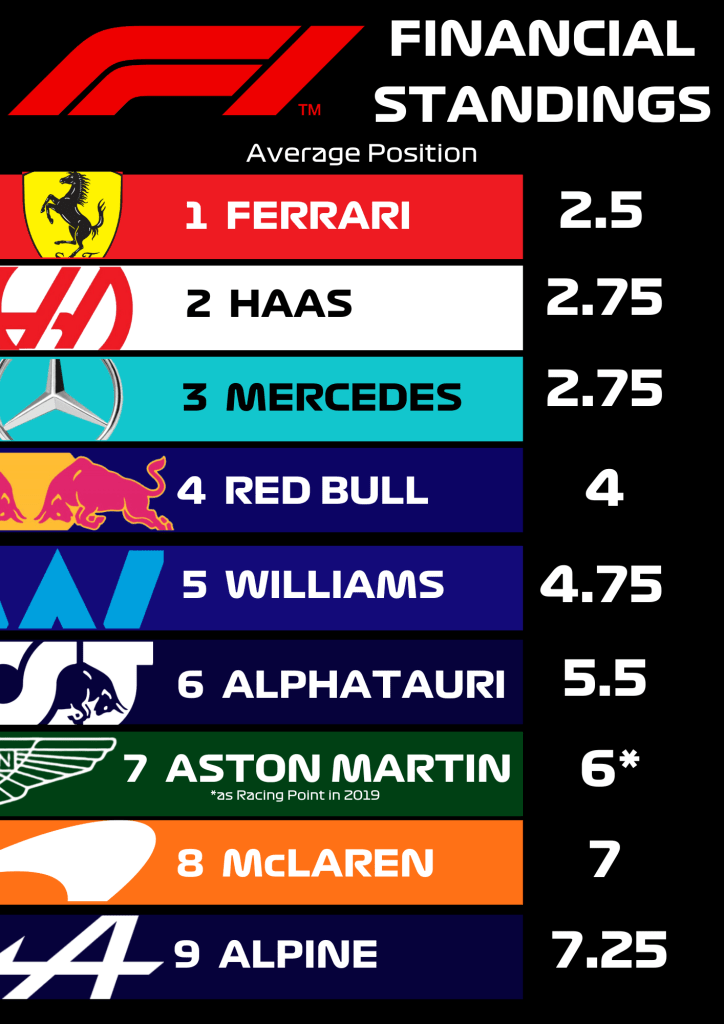

Final Standings

After four gruelling rounds of fiscal analysis, we have determined a final championship order based on the teams’ average position…

Congratulations Ferrari for actually winning something (although that is caveated with the fact the accounts are for the whole company) and Haas for their highest finishing position yet, clearly having the most money doesn’t mean you use it wisely. Also, well done to our final podium finisher Mercedes, hopefully Toto won’t be too annoyed to be beaten.

If you missed part 1, click here.

Do comment your thoughts below.

Leave a comment