One of the national treasures of the high street, Wilko, has appointed administrators as they try to find a buyer to secure the future of the ailing retailer.

The 93-year-old retailer has endured a tumultuous few years with three new CEOs in the same number of years as the beleaguered business tried to turn itself around and save the jobs of its 12,000 employees.

However, faced with mounting external pressures, spiralling debts, declining market share and falling sales, the retailer plunged into administration with current CEO Mark Jackson saying, “Given the cash position, we’ve been left with no choice but to take this unfortunate action.”

But how did Wilko get into this position? After lasting almost a century of economic ups and downs, why has Wilko been forced into decline now and can it be saved?

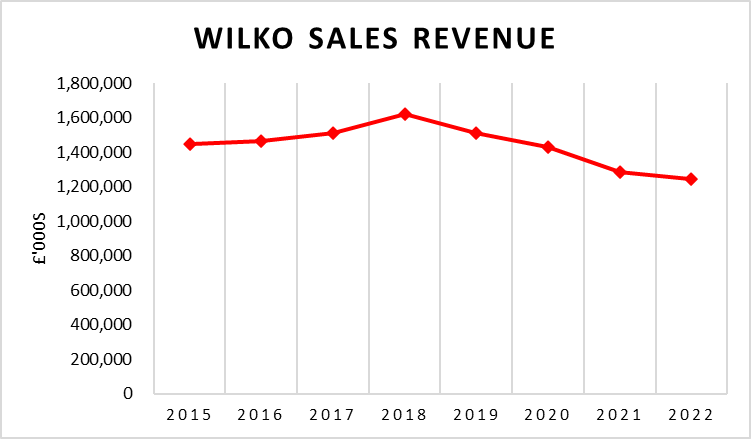

Falling Sales

In the past five years, Wilko has experienced a steady decline in sales revenue to a range of factors with the business’ turnover falling by 14% since 2018.

Part of the reason for Wilko’s falling sales is the increasing strength of its competitors (Home Bargains, B&M, The Range) who have risen to the opportunity presented by the cost of living crisis by providing low prices to customers and as a result have increased their market share and edged out Wilko.

Wilko also had a limited online presence with very high delivery fees meaning they also lost out to online competitors in addition to those in bricks and mortar retail.

In addition, Wilko had many of their 400 stores on high streets which suffered dwindling footfall after the pandemic and therefore meant more shoppers were going to out of town competitors or shopping online further reducing Wilko’s market share and overall revenues.

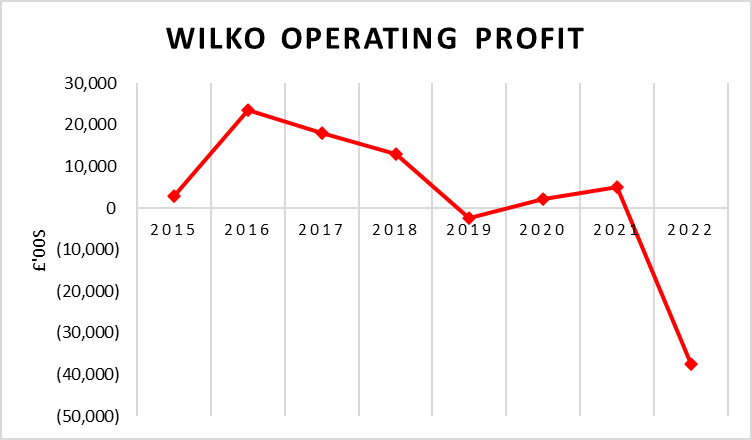

Increasing Costs

Like many businesses in recent times, Wilko have experienced higher costs due to a combination of factors including their high street locations and the problems with the energy market which have led to a significant decline in operating profit with a sizeable loss in 2022 of over £38 million.

The war in Ukraine and recent shock to the energy market have pushed energy prices to unprecedented levels and Wilko’s operating profit margin took a battering.

In addition, Wilko have been disproportionately affected as their larger high street locations had higher rents attached and after the government support from the pandemic ended Wilko were faced with a very high bill they could ill afford to pay.

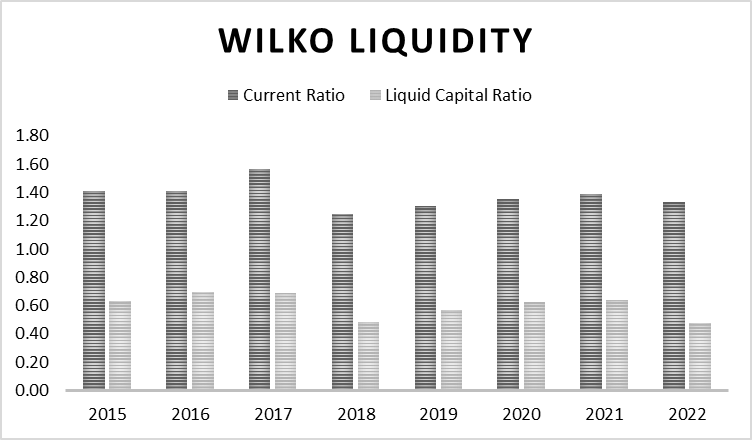

Liquidity Struggles

In late 2022, cracks began to show at Wilko as the business was forced to delay payments to suppliers and extend invoices in order to preserve its fragile cash flow position and poor liquidity.

Wilko struggled to pay their suppliers due to limited cash reserves which led them in 2022 to have a liquid capital ratio of 0.48:1 showing the business was under severe pressure to cover its day to day costs.

In addition, the majority of the value of Wilko’s current assets was tied up in stock and as the retailer sold a large amount of DIY products, much of that inventory took a considerable amount of time to sell leaving the business with an unenviable cash flow situation.

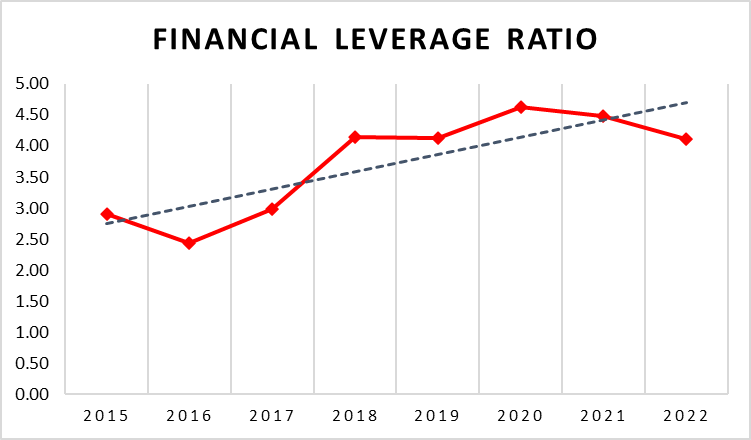

Spiralling Debts

Wilko were also burdened by increasing debts and in January 2023 the business secured a £40 million loan from Homebase owner Hilco in an attempt to overcome some of the business’ problems with the company’s debts overall increasing in recent years, peaking at over £350 million in 2020.

A significant amount of Wilko’s assets and activities were financed by debt and recently the business increased its debt burden by actioning a ‘sale and leaseback’ on its warehouse in Worksop to try and release some more capital to strengthen the business.

Wilko’s financial leverage ratio has also been increasing as the company’s debt piles higher and the equity in the business falls further peaking at 4.63:1 in 2020 evidencing that most of the assets in the business are underpinned by debts.

Despite its problems, management at Wilko are still optimistic a buyer can be found to secure a future for the company and its staff with the retailer saying they have received “a significant level of interest, including indicative offers”, however whoever buys Wilko will be facing a long project to turn the fortunes of the business around.

Do comment your thoughts below.

Leave a comment