Earlier this week, the Bank of England hosted an online ‘Q&A’ with their chief economist Huw Pill and I decided it would be worth going along (even though I had many other more pressing things to do).

Many have been deriding this event online as the supposed ‘Q&A’ (note the inverted commas) involved answering four questions in an hour and none of them really dealt with any pressing matters, more an elongated explanation of what the Bank of England does and how it works with little coherency – sometimes it was ‘Economics for Dummies’ and other times you had to really focus to keep up.

Alas, the event did include some useful information and was vaguely interesting so here’s my summary of an evening with the Bank of England…

The Bank of England is currently stuck between a rock and a hard place with current inflationary pressures having a severe impact on people across the country especially those who are vulnerable or the small businesses in energy-intensive industries, in short, those hit hardest by the cost of living crisis.

With recent CPI inflation figures well over 10%, the Bank has concluded that they are “unacceptably high” and have thus taken the logical decision to raise interest rates (base rate currently 4.5%) to make full use of the limited monetary policy tools they have to control the economy.

Many have expressed concern that the rising rates are putting undue pressure on the UK banking system and that we were on the precipice of another financial crisis however the Bank are “confident about where the banking system lies” and believe the more stringent affordability checks introduced since 2008 mean that they “don’t see a big debt crisis”.

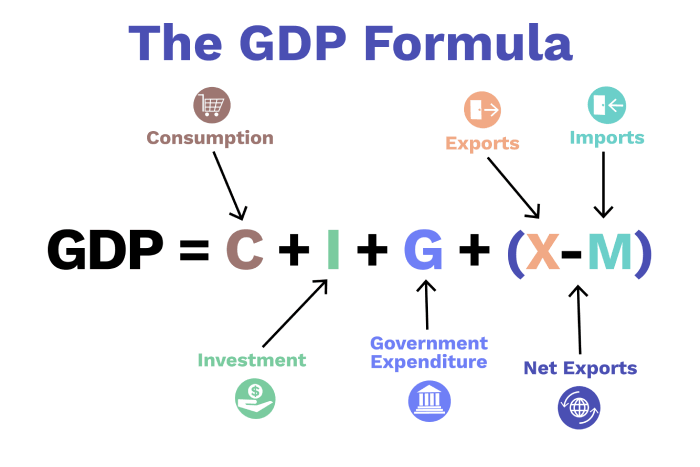

The Bank of England also shedded some light on the root of the cost of living crisis which has caused problems for so many. As many have already gathered, the catalyst was a “profound shock” to global fuel prices due to the war in Ukraine leading to an unprecedented rise which led to an increase in the price of oil and gas imports thus reducing the spending power and GDP of many major economies including the UK which suffers from energy insecurity.

Rising fuel prices were a direct contributor to our current inflation levels however the subsequent increase in other costs (such as food and other goods) was an indirect effect which led to inflation rising even further thus squeezing the incomes of individuals and profits of companies.

Thankfully, the Bank of England believe that this bleak period is behind us and the fall in gas prices (partly due to market movements and partly due to the UK Government’s Energy Price Guarantee) will lead to inflation beginning to fall with the 2% target reached by the end of next year (2024).

Another positive economic step is the Bank of England’s stable process of quantitative tightening through the sale and maturity of bonds signalling that the UK economy has recovered from the Coronavirus pandemic (now just leaving the cost of living crisis to get over).

In conclusion, the Bank of England seem relatively confident about the UK’s economic position and as they are the ones steering the ship with their monetary policy decisions we can be slightly more optimistic about our short-term economic prospects.

Do comment your thoughts below.

Leave a comment