When was the last time you bought a local newspaper? Checked their Facebook page? Even acknowledged that local media still exists in this modern world? Sadly, people are engaging in the aforementioned acts far too infrequently leading to the sorry the state we have now.

From the pillars of the community, local newspapers have been reduced to all but a pamphlet often not even being written in the town they purport to represent as they failed to adequately adapt to the digital revolution and people’s newfound reticence to print journalism.

With ever increasing costs of production, the local newspapers are almost at breaking point and the larger businesses that run them are in a state that is anything but healthy as you will soon see.

Firstly to National World/JPI Media which has been through more reincarnations than most religious figures none of which have yielded particularly positive results.

Due to their many, many different corporate structures, comprehensive and coherent accounts are hard to come by but over the past two years their performance has been comparatively decent (which says a lot). In 2020, they made a 33% net loss but in 2021 they made £5 million – profit! Such a rarity in the world of local news.

As a result of their reformation as National World, the almost laughable 2020 gearing ratio of 3623% has been reduced to a legitimately respectable 14% – maybe shutting up shop and restarting half a dozen times is the secret to success in this newspaper game.

Next onto Newsquest who also have very scant financial information but within in that is some relatively impressive (by the dismal standards set by their competitors) as they have completely recovered from the Coronavirus pandemic profitability-wise and have the most lovely liquid capital ratio of 3.51:1.

A more mediocre set of accounts (but in sufficient detail) is from Reach plc who probably should not be included in this due them being a behemoth with a few national titles in their roster which are probably propping things up to an extent.

Over the past 4 years they have averaged a 3.15% net profit margin which although not massively impressive does include a £27 million loss as a result of the Coronavirus pandemic. Liquidity may be an issue for them in the future as their liquid capital ratio is teetering around the 1:1 mark (0.4:1 in 2021).

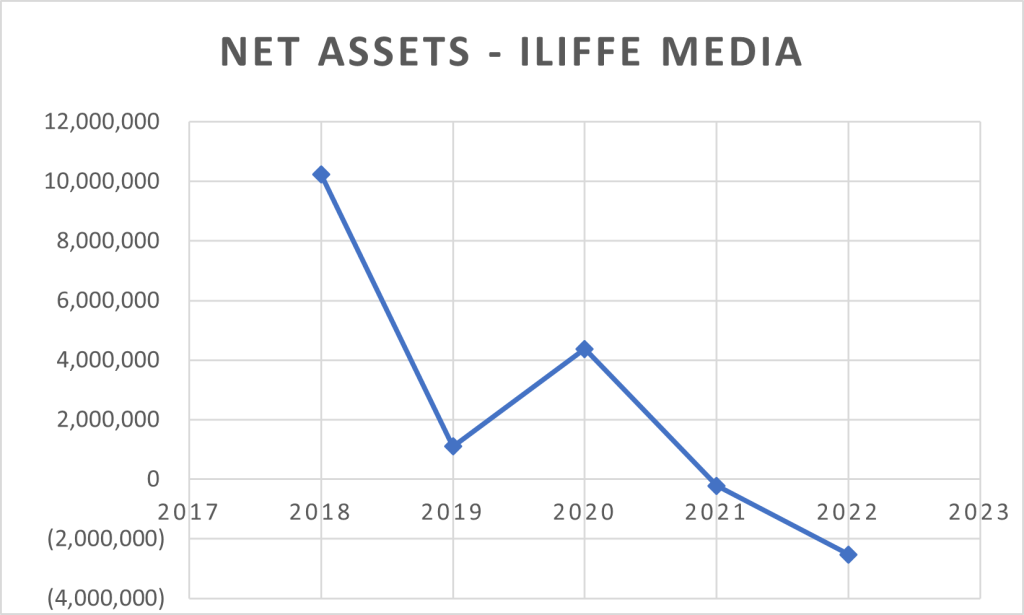

Finally it is the pretty dire case that is Iliffe Media who despite recent acquisition sprees are not doing amazingly well as the only company in my analysis who has recorded a negative net assets figure in two consecutive years – reaching the dizzying lows of -£2 million in 2022.

Profitability is also an issue for the firm based in Cambridgeshire as in the past five years they have failed to turn a profit once recording a £10 million loss in 2019 alone. Debt also seems to be an issue for the beleaguered business as in four of the past five years the gearing ratio has been greater than 100% by at least one metric.

In conclusion, the world of local newspapers is not in a particularly positive state with all the businesses involved attempting to diversify down various digital alleyways but to very minimal success.

Leave a comment