Welcome to the exciting and unprofitable world of futuristic grocery delivery. At the forefront of this industry is Ocado, the company responsible for swapping pickers and packers for robots and machines in all their warehouses.

This mechanisation all sounds great until you hear that Ocado hasn’t made a profit in all but two years of its existence and things have gone from bad to worse for the tech-focused business after a 50:50 joint venture with Marks & Spencer in August 2019.

Ocado was founded in 2000 by three former Goldman Sachs bankers as a proof of concept following their realisation that online home delivery was the future. By 2013, they had a strategic partnership with Morrison’s and were listed on the London Stock Exchange (2010).

In 2017, they diversified into the area they are probably most famous for: robots and technology for warehouses. Ocado began to focus on technology and solutions in order to make their operations more efficient and streamlined.

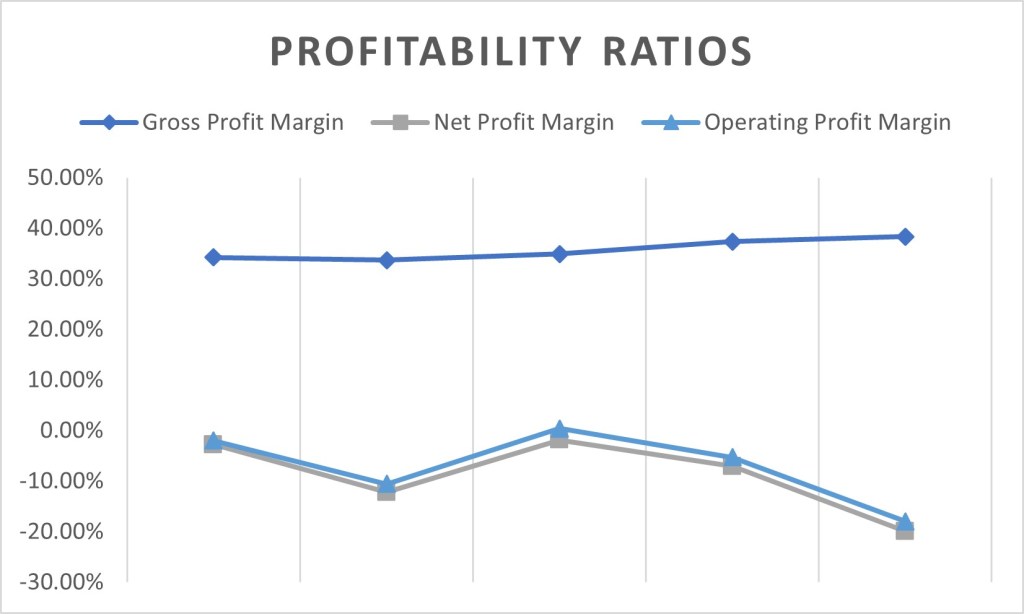

However, this constant investment in developing and installing new robotics and equipment has – like many technology companies – stifled Ocado’s ability to generate a meaningful amount of operating profit. In their history, Ocado have only turned a profit twice and the margins were not impressive.

A few months ago, Ocado issued a warning about its profits for the year that led to its share price dropping 9.8%.

In 2018, Ocado made a net loss of 2.78% and five years later (following the merger with M&S and the pandemic) made a net loss of 19.92% – over £500 million with the business showing no signs of turning that around as they aim to further their investment in fulfilment centres.

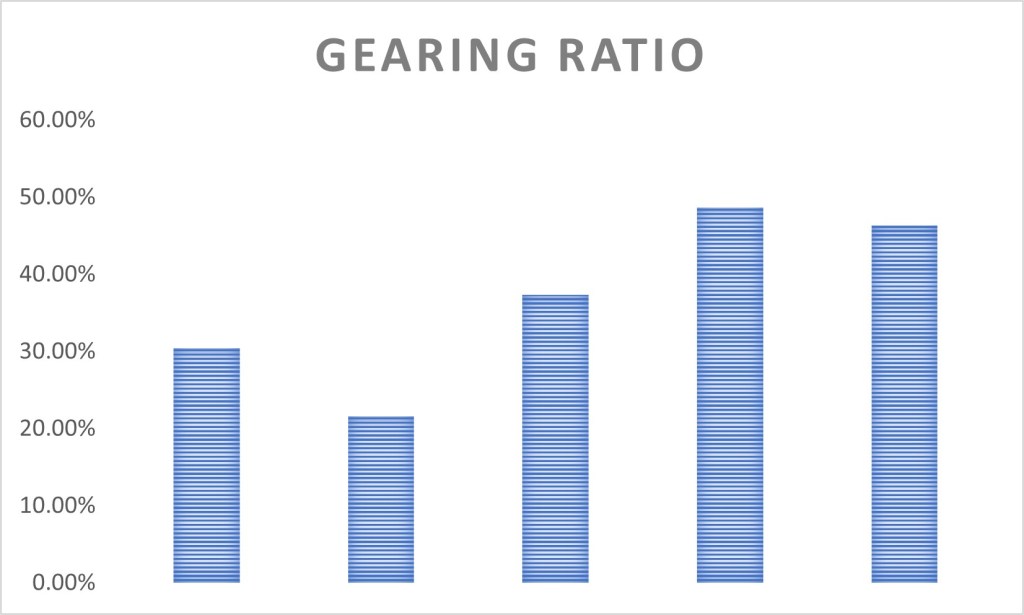

In order to continue this rampant adoption of technology, Ocado have increased their borrowing and secured extra credit facilities to sustain their growth with their gearing ratio rising to 46.35% in 2022.

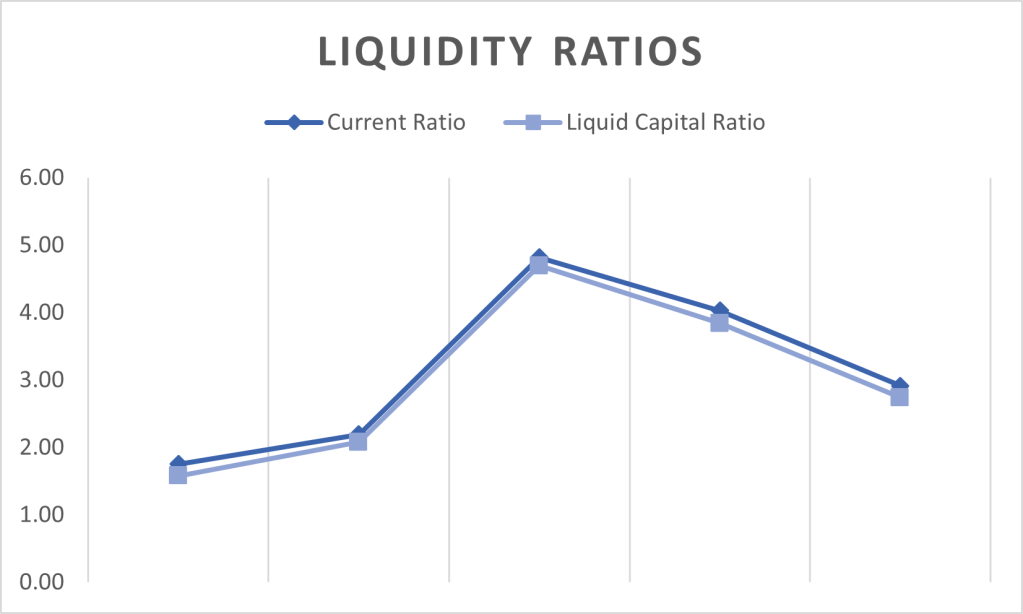

However, liquidity is not a problem for Ocado as there investors keep ploughing money into the business to finance their expansion plans with an extra £878.2 million raised this year to stabilise their liquidity as they invest in more and more technology.

The only slight flaw in this grandiose plan is that currently the retail (B2C) arm of the business is losing customers and the amount of money those who do shop there spend is also falling.

This can be explained away by the cost of living crisis however people will be restrained with their spending for a few years to come and that raises the question of how long it will take for Ocado to be profitable.

Ocado currently have 18 of its sophisticated CFC warehouses with plans for 58 in total. That means there will be an awful lot more spending before they even think about generating a return.

Ocado project that the centres will be profitable and have solid cash flow forecasts for the coming years but with adverse times still with us, I’m guessing we won’t be seeing any meaningful change for a long time yet.

Do comment your thoughts below.

Leave a comment