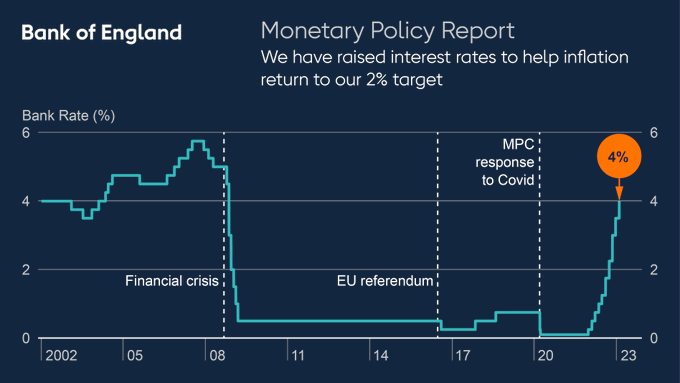

In response to the current spiraling inflation and cost of living crisis, the Bank of England has risen the UK base rate to 4% but what does this mean for your finances and the economy as a whole?

We are in an almost unprecedented financial situation with inflation at a sustained high level and the general public having to make tough decisions about their money and having to choose between heating and eating.

To try and curtail the economic issues and potential recession, interest rates have once again been risen, this time by 0.5 percentage points to 4% in an attempt to curb rising inflation.

This rate rise – like all other changes to the base rate – will have a practical impact on the finances of individuals and businesses that in some instances will be felt quite quickly.

Mortgage rates (especially tracker and variable rate mortgages) will increase rather quickly and people will quickly feel the impact of the changes – yet more increases in bills.

Savings rates will also be on the increase but the banks will take a bit longer to factor in the rate rise so watch this space for rising rates.

Other types of borrowing may see a small rise in their interest charges however they don’t follow the base rate as closely as mortgages and savings so there will be less of an immediate impact.

As for the economy as a whole, the Monetary Policy Committee (MPC) hope that their latest rate rise will reduce the significant level of inflation by further restricting spending by businesses and consumers.

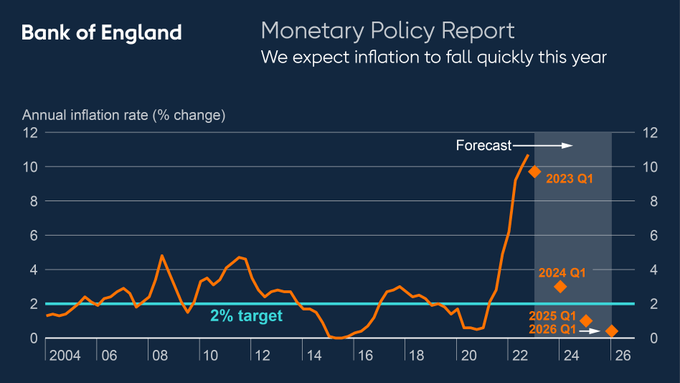

The MPC voted 7-2 in favour of raising the base rate and predict inflation to fall quickly (but remain over the 2% target) although this won’t translate to a fall in prices, more so that they will be rising less quickly.

Let’s see how this year goes financially.

Do comment your thoughts below.

Leave a comment