Formula One, the pinnacle of motorsports, an market worth millions of pounds yet a lot of F1 teams aren’t particularly profitable. Although the ultimate goal in motorsports is to win races, in order for the teams to survive they need to be lean, efficient businesses.

In this article we will mainly focus on the team at the front of the grid (Red Bull Racing) and the team bringing up the rear (Williams Racing) although many of the other teams finance their operations in a similar way.

Formula One is an expensive business to be in, to run a successful team you need to be constantly innovating with the most up-to-date machinery, travelling around the world and employing the best people meaning that being in the business necessitates a high level of capital and revenue expenditure.

In order for the 10 teams that comprise the Formula One grid, they need to generate revenue in an attempt to cover these costs with their main sources of revenue are payments from Formula One Management (FOM) and also income from their sponsors.

Each team is paid $36 million by FOM purely for being in the tournament with more payments to the teams based on their sporting performance with the winning team receiving the most ($61 million) and the last placed team collecting the least ($13 million).

FOM also gives out payments to teams for other reasons such as being a ‘heritage constructor’ (Ferrari, Williams); winning multiple titles (Mercedes, Red Bull, McLaren, Ferrari) and signing the Concorde Agreement in a timely manner.

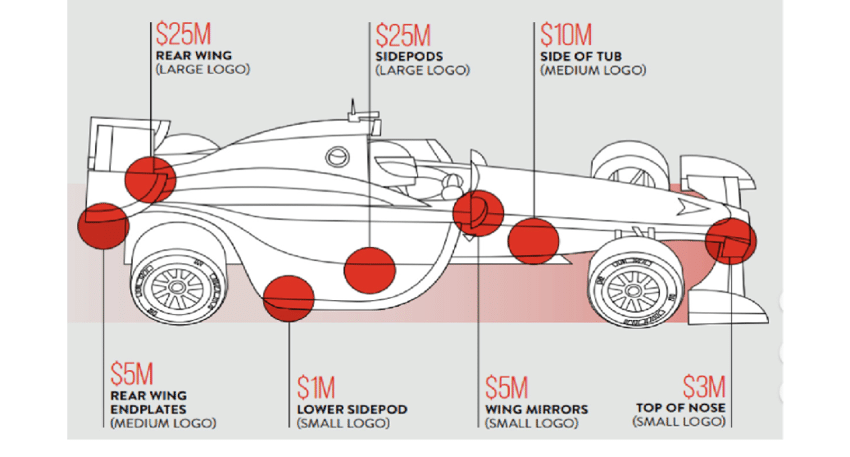

The second main source of revenue for Formula One teams is sponsorship. Millions of eyeballs look at these cars every race weekend making them valuable advertising spaces which generate the vast majority of F1 teams’ revenue.

As was the case for FOM payments, there is once again a disparity between the back and the front of the grid as the more competitive cars tend to get more time on the broadcast. Red Bull Racing’s title partner Oracle paid $500 million for their title sponsorship whereas Williams’ former title partner Rokit only paid £26 million for the privilege*.

After breaking down the sources of revenue for the F1 grid, you may be wondering whether they actually make any money. Once again there is a difference between the front running teams and the backmarkers but here are the figures:

Red Bull Racing

- Gross Profit Margin: 3.4%

- Net Profit Margin: 0.69%

- Return on Capital Employed: 19.25%

- Current Ratio: 0.96:1

Williams Racing

- Gross Profit Margin: 53.86%

- Net Profit Margin: -12.34%

- Return on Capital Employed: -12.10%

- Current Ratio: 1.17:1

As you can see, there’s quite a disparity between the front and back of the grid. Red Bull Racing actually made a profit and although the percentage seems small it equates to £1,652,000 which isn’t to be sniffed at.

Red Bull also made a greater return than Williams although that is because they actually made an operating profit! Something interesting is that Red Bull have a worse current ratio however Williams sold assets in the 2021 year (which is what I used) which may have continued to their higher current assets.

Williams made a net loss overall however the reasons for this cannot be deduced. As the gross profit margin is considerably higher than that of Red Bull, I think it’s safe to infer that somewhere along the line Williams have more expenses (possibly because Red Bull’s are partially covered by another company in the Red Bull empire?).

To summarise, F1 is a very expensive sport to be in, if you aren’t at the front you aren’t going to be making much profit and it’s a vicious cycle to get out of (you need to spend more to make more – where do you get the money from?). Although F1 is a sport first and foremost, there’s far more to it than that behind the scenes in the business of F1.

Do comment your thoughts below.

Leave a comment